At Bynd Finserve, we offer a hassle-free, flexible, and quick way to access capital by pledging your shares as collateral. A Loan Against Shares (LAS) allows you to leverage your existing stock portfolio to meet immediate financial needs, without the need to sell your assets. Whether you’re looking to seize an investment opportunity, cover business expenses, or manage personal financial requirements, a loan against shares can be a smart solution.

A Loan Against Shares is a type of secured loan where you can pledge your stocks, mutual funds, or other marketable securities as collateral to borrow money. The loan amount is typically a percentage of the market value of the pledged securities, and the interest rate is often lower compared to unsecured loans since the loan is backed by your assets.

Start Investing Today

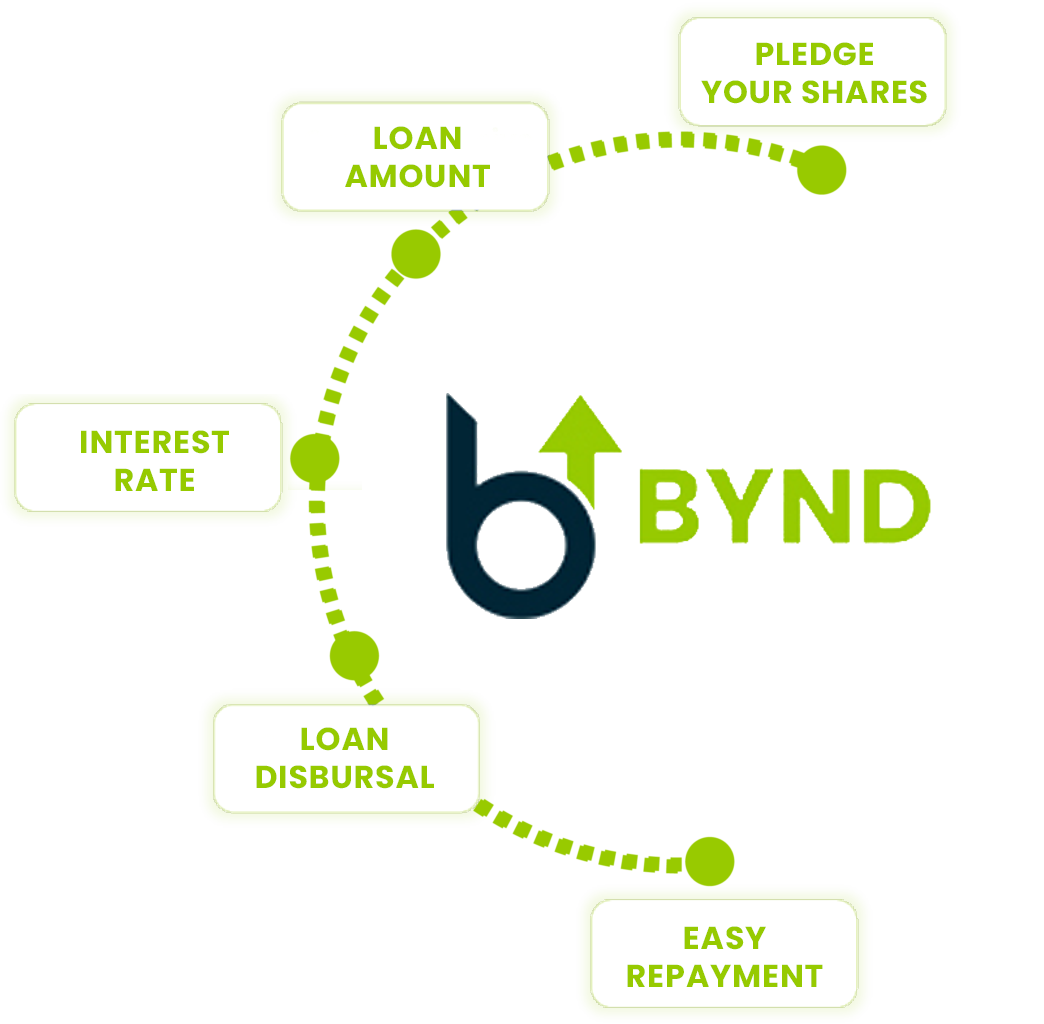

You can pledge a range of eligible securities, including listed stocks, mutual funds, and ETFs, as collateral.

Based on the value of the pledged securities, you will be eligible for a loan amount (typically a percentage of the market value).

Interest rates are determined based on the value of the pledged shares and the overall loan amount.

Once the loan is approved, the funds are disbursed directly to your account, typically within a few business days.

Repay the loan in easy installments over the agreed period. Once the loan is repaid, the pledged shares are released back to you.

At Bynd Finserve, we understand the value of your investments and the need for quick access to liquidity. Our Loan Against Shares offering is designed with your convenience in mind:

A loan against shares is an ideal solution for a wide range of individuals and businesses, including:

Applying for a Loan Against Shares with Bynd Finserve is simple and fast:

Sign up on our website and complete a quick application form.

Choose the securities you wish to pledge as collateral for the loan.

Our team will review the value of your pledged shares & approve the loan quickly.

Once approved, the loan amount will be transferred to your account in no time.

Pay back the loan as per the agreed terms, and once it’s cleared, your shares will be released.

A Loan Against Shares can be the ideal solution when you need immediate access to funds without selling your investments. At Bynd Finserve, we’re committed to providing you with the most competitive rates and the fastest service.